Advanced Trading Process | Step-by-Step Guide (2025)

Advanced Trading Process — Step-by-Step Guide (2025)

Advanced Trading Process — Step-by-Step Guide (2025)

📈 What is Advanced Trading?

Advanced trading refers to using sophisticated strategies and tools to maximize profits and manage risk in stock, options, futures, and forex markets. Unlike basic trading, advanced trading involves:

- Technical and fundamental analysis integration

- Intraday strategies with leverage

- Options spreads, hedging, and multi-leg trades

- Risk management and position sizing

💡 Why Advanced Trading is Important

Simple buy-and-hold strategies are not always enough in volatile markets. Advanced trading allows traders to:

- Protect capital during market downturns

- Leverage small capital for higher returns

- Implement multiple strategies based on market conditions

- Analyze trends, patterns, and indicators effectively

📊 Step-by-Step Advanced Trading Process

Here’s a structured approach for advanced traders:

- Market Preparation: Review global markets, economic news, and corporate announcements before trading.

- Technical Analysis: Study candlestick patterns, support/resistance levels, moving averages, RSI, MACD, Bollinger Bands, and trend lines.

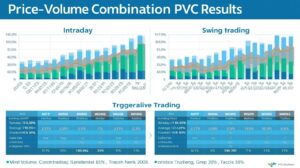

- Strategy Selection: Decide whether to use intraday scalping, swing trading, options spreads, or hedging strategies.

- Position Sizing: Allocate capital based on risk per trade. Never risk more than 1–2% of total capital per trade.

- Entry and Exit Points: Set precise entry, stop-loss, and profit target levels based on technical analysis.

- Execution: Use broker platforms (Zerodha Kite, Upstox, ICICI Direct) with real-time charts for accurate order placement.

- Monitoring: Watch open positions, adjust stop-loss if market conditions change, and avoid emotional reactions.

- Review and Learning: Maintain a trading journal, record each trade’s outcome, mistakes, and lessons.

💸 Advanced Risk Management

Risk management is the backbone of advanced trading. Key tips include:

- Set strict stop-loss for every position

- Use trailing stops for dynamic risk control

- Hedge positions using options or other derivatives

- Maintain a diversified portfolio across sectors and instruments

- Avoid overleveraging — leverage amplifies both profits and losses

📈 Advanced Trading Tools

Top tools for serious traders:

- Charting Platforms: TradingView, Sensibull, Kite charts

- News & Alerts: Bloomberg, Reuters, Economic Times, Moneycontrol

- Scanner Tools: Stock/option screeners for high probability trades

- Risk & Portfolio Management Tools

🧠 Trading Psychology for Advanced Traders

Mental discipline is critical for advanced trading:

- Follow a pre-defined trading plan without deviations

- Accept losses calmly — even advanced traders face losing trades

- Focus on probability and risk-reward ratios, not greed

- Control overconfidence and emotional bias

💰 Profit Expectations and Realistic Goals

Advanced trading allows higher potential returns but requires experience and discipline:

- Small traders: 5–15% monthly returns are realistic with disciplined trading

- Experienced traders: 15–25% monthly is achievable using advanced strategies

- Long-term compounding of profits is essential for wealth building

🔑 Top Advanced Trading Strategies

- Options spreads (bull call, bear put spreads)

- Straddles and strangles for volatility plays

- Swing trading using moving averages and trend indicators

- Intraday scalping using 5-min and 15-min charts

- Hedging long-term positions using options or futures

⚠️ Common Mistakes in Advanced Trading

- Ignoring risk management and overleveraging

- Lack of proper analysis before entry

- Emotional decisions and revenge trading

- Not keeping a trading journal or reviewing mistakes

📆 Sample Advanced Trading Daily Routine

- 8:30 AM — Pre-market analysis and news review

- 9:00 AM — Identify potential trades and set alerts

- 9:15 AM — Execute trades with predefined stop-loss and targets

- 11:30 AM — Review open positions and adjust risk if needed

- 1:30 PM — Mid-day review, watch key support/resistance levels

- 3:20 PM — Close intraday positions and record outcomes

- 4:00 PM — Analyze results, update trading journal, plan for next day

🏁 Conclusion — Mastering Advanced Trading

Advanced trading is a blend of strategy, analysis, risk management, and psychology. Success comes from consistent practice, disciplined execution, and continuous learning. Whether you trade stocks, options, or futures, following a structured process ensures long-term profitability and reduces unnecessary risks.

Focus Keywords: advanced trading process, intraday strategies, options trading advanced, stock market 2025, technical analysis, risk management trading, trading psychology