Momentum Trading Strategy & Screener | 2025 Step-by-Step Guide

Momentum Trading Strategy & Screener — Step-by-Step Guide (2025)

Momentum Trading Strategy & Screener — Step-by-Step Guide (2025)

📌 What is Momentum Trading?

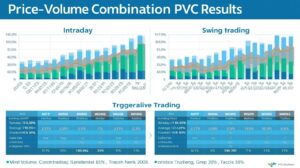

Momentum trading is a strategy where traders buy stocks that are moving strongly in one direction and sell them before the trend reverses. The idea is to ride the “momentum” of a stock to profit from quick price movements.

It is widely used in **intraday, swing trading, and options trading**, and works best in high-volatility markets with strong volume activity.

💡 Why Momentum Trading Works

- Markets often move in trends — stocks rarely move randomly.

- Strong buying or selling pressure can continue for short periods, allowing traders to capture gains.

- Combining momentum with volume increases the probability of profitable trades.

📊 Step-by-Step Momentum Trading Strategy

- Identify High-Momentum Stocks: Use a screener to filter stocks with high volume and strong price movement.

- Confirm the Trend: Check moving averages (EMA 9, EMA 21) and RSI (>70 for bullish, <30 for bearish).

- Entry Point: Buy when price breaks above resistance with strong volume, or sell when breaking support in a downtrend.

- Set Stop-Loss: Place stop-loss just below support (for long trades) or above resistance (for short trades).

- Target Profit: Define risk-reward ratio (1:2 or 1:3) and exit when momentum weakens.

- Monitor Volume: Volume should confirm trend — decreasing volume may signal reversal.

- Exit Strategy: Exit when price loses momentum, RSI signals overbought/oversold, or target is reached.

💻 Momentum Screener Setup

Use a stock screener to automatically filter stocks with momentum potential:

- Price Change: Filter stocks with 3–10% intraday or daily movement.

- Volume Spike: Volume 50–100% higher than average

- Technical Indicators: RSI > 60 for bullish, MACD bullish crossover

- Sector or Market Cap: Focus on liquid stocks for faster execution

🧠 Advanced Momentum Trading Tips

- Combine momentum with trend indicators like EMA, VWAP, or Bollinger Bands

- Focus on liquid stocks to avoid slippage

- Trade in the first 1–2 hours of market open — highest momentum often occurs then

- Use trailing stop-loss to lock profits as momentum continues

- Monitor news and events — earnings announcements or sector news can trigger strong momentum

⚠️ Common Mistakes in Momentum Trading

- Chasing the stock after it has already moved significantly — risk of reversal

- Ignoring volume confirmation — low volume trends often fail

- No stop-loss — can result in heavy losses if momentum suddenly reverses

- Overtrading — too many trades reduce focus and increase risk

📆 Daily Routine for Momentum Traders

- 8:30 AM — Scan pre-market for high-momentum candidates

- 9:00 AM — Identify potential entries using screener and chart analysis

- 9:15 AM — Execute trades with predefined entry, stop-loss, and target

- 11:30 AM — Review open positions, adjust stop-loss if necessary

- 1:30 PM — Check momentum continuation or reversal signals

- 3:20 PM — Exit trades and record results in trading journal

- 4:00 PM — Analyze the day’s trades and refine strategy

🏁 Conclusion — Mastering Momentum Trading

Momentum trading is a powerful strategy for traders who can react quickly and manage risk. By using a well-designed screener, confirming trends with volume and indicators, and following strict stop-loss and target rules, traders can consistently identify profitable opportunities.

Remember, momentum is temporary — disciplined entries and exits, risk management, and constant learning are the keys to long-term success in 2025 and beyond.

Focus Keywords: momentum trading strategy, momentum screener, trending stocks, intraday trading 2025, stock screener, entry exit strategy, risk management trading

Momentum Trading Strategy & Screener — Step-by-Step Guide (2025)

📌 What is Momentum Trading?

Momentum trading is a strategy where traders buy stocks that are moving strongly in one direction and sell them before the trend reverses. The idea is to ride the “momentum” of a stock to profit from quick price movements.

It is widely used in **intraday, swing trading, and options trading**, and works best in high-volatility markets with strong volume activity.

💡 Why Momentum Trading Works

- Markets often move in trends — stocks rarely move randomly.

- Strong buying or selling pressure can continue for short periods, allowing traders to capture gains.

- Combining momentum with volume increases the probability of profitable trades.

📊 Step-by-Step Momentum Trading Strategy

- Identify High-Momentum Stocks: Use a screener to filter stocks with high volume and strong price movement.

- Confirm the Trend: Check moving averages (EMA 9, EMA 21) and RSI (>70 for bullish, <30 for bearish).

- Entry Point: Buy when price breaks above resistance with strong volume, or sell when breaking support in a downtrend.

- Set Stop-Loss: Place stop-loss just below support (for long trades) or above resistance (for short trades).

- Target Profit: Define risk-reward ratio (1:2 or 1:3) and exit when momentum weakens.

- Monitor Volume: Volume should confirm trend — decreasing volume may signal reversal.

- Exit Strategy: Exit when price loses momentum, RSI signals overbought/oversold, or target is reached.

💻 Momentum Screener Setup

Use a stock screener to automatically filter stocks with momentum potential:

- Price Change: Filter stocks with 3–10% intraday or daily movement.

- Volume Spike: Volume 50–100% higher than average

- Technical Indicators: RSI > 60 for bullish, MACD bullish crossover

- Sector or Market Cap: Focus on liquid stocks for faster execution

🧠 Advanced Momentum Trading Tips

- Combine momentum with trend indicators like EMA, VWAP, or Bollinger Bands

- Focus on liquid stocks to avoid slippage

- Trade in the first 1–2 hours of market open — highest momentum often occurs then

- Use trailing stop-loss to lock profits as momentum continues

- Monitor news and events — earnings announcements or sector news can trigger strong momentum

⚠️ Common Mistakes in Momentum Trading

- Chasing the stock after it has already moved significantly — risk of reversal

- Ignoring volume confirmation — low volume trends often fail

- No stop-loss — can result in heavy losses if momentum suddenly reverses

- Overtrading — too many trades reduce focus and increase risk

📆 Daily Routine for Momentum Traders

- 8:30 AM — Scan pre-market for high-momentum candidates

- 9:00 AM — Identify potential entries using screener and chart analysis

- 9:15 AM — Execute trades with predefined entry, stop-loss, and target

- 11:30 AM — Review open positions, adjust stop-loss if necessary

- 1:30 PM — Check momentum continuation or reversal signals

- 3:20 PM — Exit trades and record results in trading journal

- 4:00 PM — Analyze the day’s trades and refine strategy

🏁 Conclusion — Mastering Momentum Trading

Momentum trading is a powerful strategy for traders who can react quickly and manage risk. By using a well-designed screener, confirming trends with volume and indicators, and following strict stop-loss and target rules, traders can consistently identify profitable opportunities.

Remember, momentum is temporary — disciplined entries and exits, risk management, and constant learning are the keys to long-term success in 2025 and beyond.

Focus Keywords:, momentum screener, trending stocks, intraday trading 2025, stock screener, entry exit strategy, risk management trading