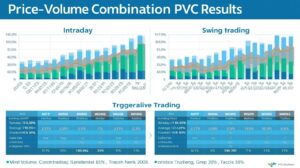

Price-Volume Combination (PVC) Results | Intraday & Swing Trad

Price-Volume Combination (PVC) Results | Intraday & Swing Trad

Price-Volume Combination (PVC) Results — Step-by-Step Trading Guide (2025)

📌 What is Price-Volume Combination (PVC)?

Price-Volume Combination (PVC) is a trading analysis technique that combines **price movements** and **volume trends** to identify high-probability trades. By studying how price reacts with changing volume, traders can detect trends, reversals, breakouts, and potential continuations in the market.

PVC is widely used in intraday trading, swing trading, and options trading because it provides **strong signals for entry and exit points**.

💡 Why PVC Matters

Understanding price without volume can be misleading. Similarly, volume alone doesn’t provide the whole picture. PVC helps traders:

- Identify strong trends supported by volume

- Spot potential reversals before they happen

- Validate breakouts or breakdowns

- Determine the strength of a move — weak moves often have low volume

📊 How Price-Volume Combination Works

Price and volume together give you a **confirmation mechanism**:

- Rising Price + Rising Volume: Confirms a strong uptrend; buyers are active

- Rising Price + Falling Volume: Trend may be weak; could reverse

- Falling Price + Rising Volume: Confirms a strong downtrend; selling pressure is high

- Falling Price + Falling Volume: Weak downtrend; may bounce back

🧠 Interpreting PVC Results for Intraday Trading

Intraday traders use PVC to make quick decisions. Here’s how to interpret results:

- Look for volume spikes near support/resistance levels

- Confirm breakout only if accompanied by higher-than-average volume

- Ignore moves without volume confirmation — often false signals

- Use PVC along with intraday indicators like VWAP, EMA, or RSI for better accuracy

💹 Case Study: PVC in Action

Example: Stock XYZ at ₹500, daily volume 1,00,000 shares.

- Price rises to ₹520 with volume 1,50,000 → strong uptrend confirmed (PVC bullish)

- Price rises to ₹520 but volume only 80,000 → weak trend; caution needed

- Price drops to ₹480 with volume 2,00,000 → strong bearish move (PVC bearish)

📈 PVC in Swing Trading

Swing traders analyze PVC over days or weeks to catch medium-term trends:

- Rising price + rising volume over multiple days = bullish continuation

- Price consolidating with declining volume = potential breakout soon

- Falling price with high volume = strong bearish trend; avoid long positions

💻 Tools and Platforms for PVC Analysis

- Charting Platforms: TradingView, Zerodha Kite, Upstox Pro, Angel Broking

- Volume Indicators: OBV (On-Balance Volume), Volume Profile, VWAP

- Screeners: Filter stocks based on volume spikes and price changes

- News & Alerts: Bloomberg, Moneycontrol, Reuters for real-time confirmation

🔑 Top PVC Trading Strategies

- Breakout Confirmation: Enter trades only if price breakout is accompanied by rising volume

- Reversal Detection: Watch for volume divergence — rising volume in price decline or vice versa

- Volume Spikes: Spot intraday trend reversals on sudden high-volume bars

- Support/Resistance Validation: PVC validates whether price can sustain above/below key levels

- Intraday Momentum Trades: Combine PVC with moving averages and RSI to ride intraday trends

⚠️ Common Mistakes Using PVC

- Ignoring context — volume alone cannot predict trend

- Reacting too early — wait for confirmation with price-volume alignment

- Using low liquidity stocks — false signals are common

- Not integrating other indicators — PVC works best with trend and momentum analysis

📆 Sample Daily Routine Using PVC

- 8:30 AM — Pre-market scan for high-volume stocks

- 9:00 AM — Mark key support/resistance and observe volume spikes

- 9:15 AM — Execute trades only when PVC confirms trend

- 11:30 AM — Adjust stop-loss based on PVC trend confirmation

- 1:30 PM — Mid-day review and look for intraday swing opportunities

- 3:20 PM — Close intraday positions using PVC confirmation

- 4:00 PM — Analyze trades and record PVC insights in journal

🏁 Conclusion — Using PVC for Better Trading Decisions

Price-Volume Combination is one of the most reliable tools for intraday and swing traders. By combining price trends with volume analysis, traders can:

- Confirm trends

- Spot reversals early

- Filter false signals

- Improve entry and exit timing

Integrating PVC with risk management, charting tools, and trading psychology allows traders to make **consistent, profitable decisions** in volatile markets.

Focus Keywords: Price Volume Combination, PVC trading, intraday trading 2025, volume analysis, price-volume strategy, trading guide, stock analysis PVC