Ultimate Intraday Charting & Screener Guide — Step-by-Step 2025

Ultimate Intraday Charting & Screener Guide — Step-by-Step 2025

Ultimate Intraday Charting & Screener Guide — Step-by-Step 2025

📈 What is Intraday Charting and Screener?

Intraday charting is the practice of analyzing stock price movements on a short-term basis using charts, technical indicators, and patterns to make quick trades within the same trading day. A stock screener helps traders filter stocks based on predefined criteria like volume, volatility, trend, or technical indicators.

Combined, charting and screeners allow intraday traders to identify high-probability trades efficiently and maximize profits while managing risk.

💡 Why It’s Essential for Intraday Traders

Without proper charting and screening:

- Traders may waste time on low-probability trades

- Risk increases due to poor entry/exit decisions

- It’s harder to spot intraday trends and momentum

With the ultimate charting and screener strategy, you can:

- Quickly identify stocks showing strong momentum

- Set precise entry and exit levels

- Minimize losses with risk management

- Automate part of your analysis using screeners

📊 Step-by-Step Ultimate Intraday Charting Process

- Select Stocks: Use high-volume, liquid stocks or indices for quick trades.

- Choose Chart Type: Candlestick charts are most reliable for intraday patterns.

- Set Time Frame: 1-minute, 5-minute, or 15-minute charts for entry/exit points.

- Apply Indicators: Moving Averages, RSI, MACD, Bollinger Bands, VWAP, and Fibonacci retracement for trend and momentum analysis.

- Identify Patterns: Breakouts, reversals, flags, triangles, and support/resistance zones.

- Entry & Exit: Define clear stop-loss and target levels based on chart and indicator signals.

- Monitor in Real-Time: Track volume spikes, price action, and market news.

- Review & Journal: Maintain a trading log of every trade with charts, notes, and outcomes.

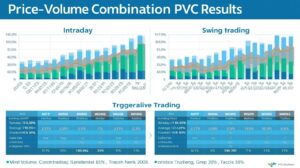

💸 Using Stock Screeners for Intraday Trading

A stock screener helps filter out the best stocks for intraday trading based on your strategy:

- Volume Screener: Find stocks with unusually high trading volume.

- Price Action Screener: Identify breakouts, gaps, or trend reversals.

- Technical Indicator Screener: Filter based on RSI, MACD crossovers, or Bollinger Band signals.

- Volatility Screener: Target stocks with sufficient price movement to capture intraday profit.

📈 Best Tools & Platforms for Charting and Screening

- Trading Platforms: Zerodha Kite, Upstox Pro, Angel Broking, ICICI Direct

- Charting Tools: TradingView, Sensibull, Trendlyne, Investing.com

- Stock Screeners: Screener.in, TradingView stock filters, Kite Screener

- News & Alerts: Moneycontrol, Bloomberg, Economic Times, Reuters

🧠 Advanced Strategies for Intraday Charting

- Breakout Strategy: Buy when price breaks above resistance or sell below support.

- Pullback Strategy: Enter on retracement in a strong trend.

- Volume Spike Trading: Trade stocks showing sudden increase in volume.

- Momentum Strategy: Focus on stocks with high relative strength index (RSI) momentum.

- Gap Trading: Trade stocks that gap up/down at market open with proper stop-loss.

⚠️ Risk Management for Intraday Trades

- Set stop-loss for every trade — never skip it

- Limit risk to 1–2% of total capital per trade

- Use trailing stop-loss for winning trades

- Avoid overleveraging — leverage amplifies both gains and losses

- Exit trades if market conditions suddenly reverse

📆 Daily Routine for Ultimate Intraday Trading

- 8:30 AM — Pre-market scanning and chart setup

- 9:00 AM — Identify high-probability stocks using screener

- 9:15 AM — Execute trades with predefined entries and stop-loss

- 11:30 AM — Monitor positions and adjust stop-loss

- 1:30 PM — Mid-day review and prepare for second half of session

- 3:20 PM — Close all intraday trades and log results

- 4:00 PM — Analyze performance, update trading journal, and plan for tomorrow

🏁 Conclusion — Mastering Intraday Charting & Screener

Ultimate intraday charting combined with a stock screener can significantly improve trading efficiency and profitability. Consistent practice, disciplined risk management, and structured strategies are essential. By following a step-by-step process and reviewing every trade, traders can build expertise, reduce mistakes, and maximize intraday profits in 2025.

Focus Keywords: intraday charting, stock screener,, technical analysis, day trading tips, best screener tools 2025, charting for traders